- Investing in real estate is at the top of most ultra-high net worth earners lists. Is it at the top of yours?

According to a 2024 article published by CNBC, nearly 27% of centimillionaires’ (over $100 million net-worth) portfolio is in real estate and that percentage is rising. Why are they investing so heavily in real estate? Well, the article outlines these simple reasons; stability, cashflow, appreciation, and diversification.

Let’s look at why long-term renting should be the most important part of your investment plan.

What is Long-term Rental Investing?

Long-term rentals are a simple concept. Buy homes or apartments, rent them out on long term lease agreements for a year or more. You can help build the community by offering stable housing for people and families and begin crafting your reputation locally. This means steady cash flow and less change for you. Also meaning lower vacancy rates and fewer hassles with running the business.

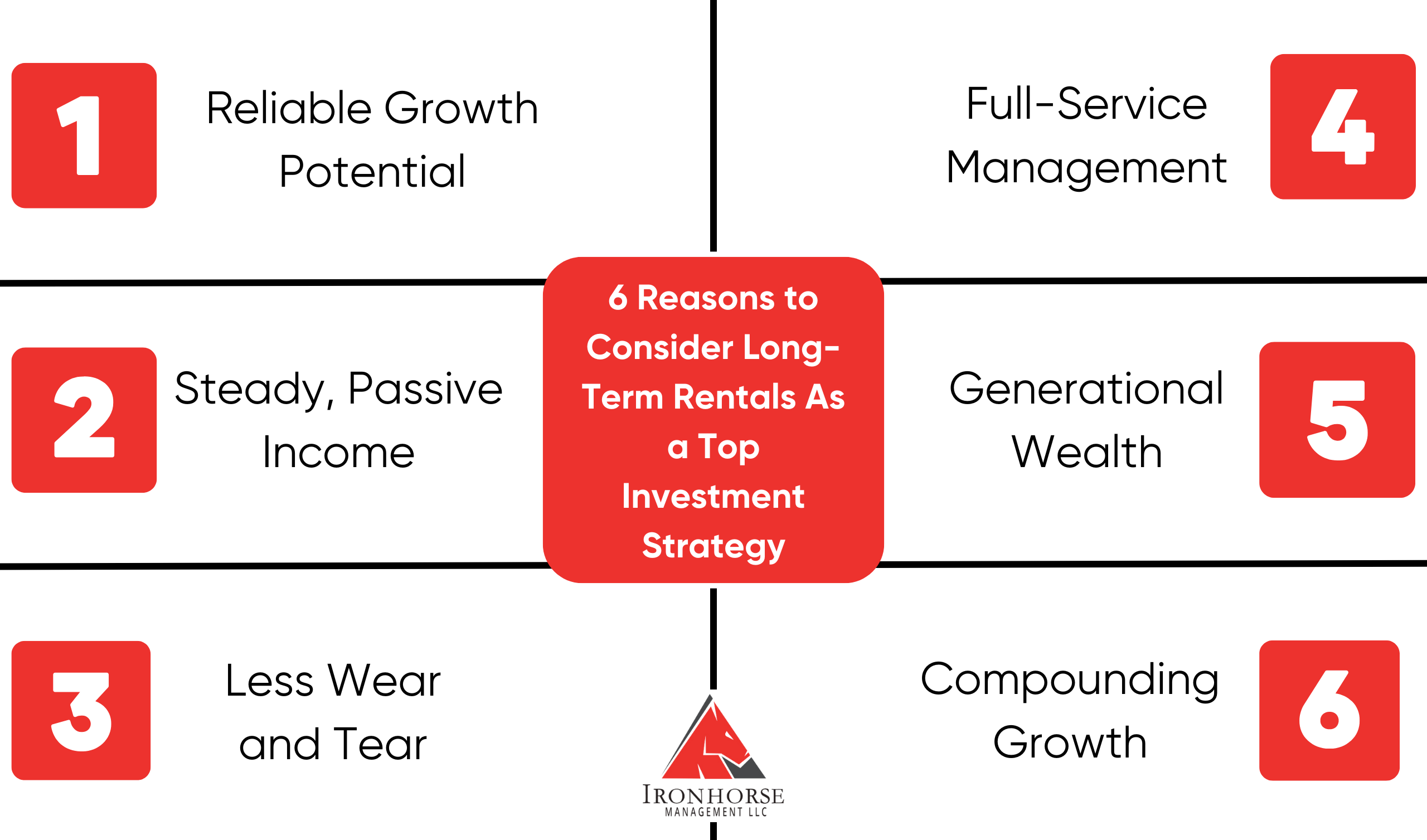

6 Reasons to Consider Long-Term Rentals As a Top Investment:

There are many great things about long-term rentals for owners that make them stand out in the real estate market and catch the eye of top-earners.

Here are six important reasons why long-term rentals should be at the top of your business list:

1. Reliable Growth Potential: Unlike the volatility often associated with short-term rental markets, long-term rentals offer steady appreciation over time. As you acquire multiple properties and build your portfolio, the equity in your investments grows, providing a solid foundation for long-term wealth accumulation.

2. Steady, Passive Income: Since most contracts are for a year or more, residents pay the same amount of rent every month. You can pay your mortgage, property taxes, and other costs with this steady stream of income while still having extra cash on hand. You can also enjoy passive income without the hassles of day-to-day management if you hire the right property management company.

3. Less Wear and Tear: With residents settling in for longer durations, there’s less turnover and fewer disruptions to the property. This translates to lower maintenance costs and less frequent renovations, saving you time and money in the long run. Additionally, residents who view the property as their long-term home are more likely to take better care of it, further reducing the risk of damage.

4. Full-Service Management (Property Management Company): Managing rental properties can be a time-consuming endeavor, especially if you’re juggling multiple units, properties or other investments. That’s why most rental property owners lean on property management companies.

From finding and screening residents to handling maintenance requests and collecting rent, we take care of all the details so you can focus on growing your investment portfolio. Our comprehensive services ensure that your properties are well-maintained and profitable, giving you peace of mind and maximizing your returns.

5. Generational Wealth: Investing in long-term rentals offers a powerful way to build and sustain generational wealth. As the property appreciates in value and the rental income continues, this asset can be passed down to future generations, ensuring financial security and creating a lasting legacy.

6. Compounding Growth: As rental income is reinvested or used to acquire additional properties, the value of your real estate portfolio can grow exponentially. This compounding effect can significantly enhance your family’s wealth over time, providing a solid financial foundation for children and grandchildren.

Strategies for Success in Long-Term Rentals:

To be successful at long-term rental investing, you need a plan that improves returns while minimizing risks. Long-term rentals have special benefits that investors can take advantage of. Use smart strategies to build a strong portfolio for long-term wealth growth.

We will talk about some of the best ways for investors to do well in the long-term rental market in this part. These strategies will help investors reach their financial goals and ensure long-term prosperity, from taking advantage of future investment chances to making the most of portfolio diversification:

- Future Investment Opportunities: Banks and lenders tend to favor long-term rental income over short-term income when evaluating loan applications. By focusing on long-term rentals, you can improve your chances of securing favorable financing terms and expanding your investment portfolio.

With each property added to your portfolio, you’re not just building wealth; you’re also strengthening your financial position and opening up new growth opportunities.

- Portfolio Diversification: Diversification is key to a resilient investment strategy, and long-term rentals offer a valuable way to diversify your portfolio. Unlike stocks and other traditional investments, real estate provides tangible assets that are less susceptible to market fluctuations.

By spreading your investments across different properties and locations, you can mitigate risk and protect your wealth against economic downturns. Long-term rentals, with their stable income streams and appreciation potential, are an excellent addition to any diversified portfolio.

- Equity Wealth: One of the greatest advantages of long-term rental investing is the opportunity to build equity wealth over time. As property values appreciate and mortgage balances decrease, your equity in the property grows. This built-in equity can be leveraged for future investments or used to finance other ventures.

Looking to expand your real estate portfolio or pursue other investment opportunities? The equity accumulated through long-term rentals provides valuable financial flexibility and security.

Don’t Let Long-Term Rentals Monopolize Your Time. Let The Professionals Take The Reigns

For owners looking for steady growth, steady income, and a diversified portfolio, long-term rentals have a lot to offer. We want to help you get the most out of your property investments.

Get in touch with our team at Ironhorse Management and request a consultation. No matter how much experience you have as an investor or if this is your first property, our team of professionals is here to help you every step of the way.

Starting your real estate investing in Bozeman? Here is our Ultimate Guide to Property Management to help get you started.